The Consumer Price Index shows inflation at just 3.8%, but how accurate is that figure? Every time I shop, it feels much higher.

Recently, I was successful in getting a Senate Inquiry into how the Australian Bureau of Statistics (ABS) maintain the inflation index and the answers were interesting—inflation is worse than the official figure suggests.

The ABS actually produce several different measures of prices changes. The media often cites one of them – the CPI, which serves economists, bankers and the treasury, who use it to see how the economy is going as a whole, but it’s not an accurate measure of price changes that affects consumers.

To address this, the ABS produce the Living Cost Index (LCI), which looks at how much the cost-of-living has changed for different groups. The largest of these groups is for employees, which covers about 70% of Australians and reveals that inflation is actually 6.2%, significantly higher than the CPI figure of 3.8%. This difference largely stems from how house price increases are included in the index.

So, it’s clear: people are struggling more than the CPI suggests. If you feel like you’re working harder and getting nowhere, it’s because you are.

One Nation is committed to reducing government spending, reducing inflation and making your pay stretch further.

Transcript

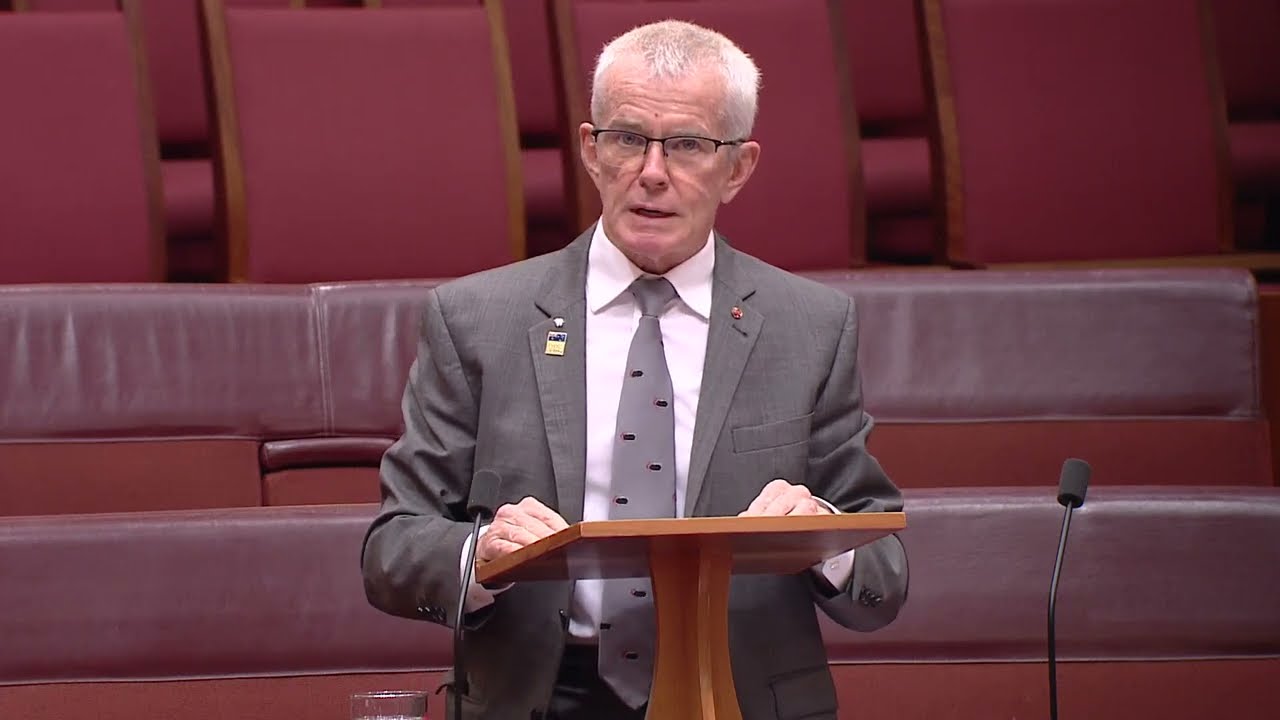

I rise to take note of the Economic References Committee report into the Australian Bureau of Statistics production of inflation statistics. This inquiry was called on a Senate motion that One Nation introduced. I thank the committee for their time and I thank the Australian Bureau of Statistics for their honest, direct and professional answers. In an answer to my question in Senate estimates, the Reserve Bank governor advised that it uses many other indicators to get a clearer understanding of the cost of living affecting everyday Australians, not just the CPI. This was the comment that led to last week’s inquiry. Many people assume the CPI is an accurate picture of the cost of living for everyday Australians. What we learned from the ABS, the Australian Bureau of Statistics, is the consumer price index is a macro economic indicator useful to the government, Reserve Bank and industry to show how much prices have changed. That’s not the same as asking how much cost-of-living spending has increased for everyday Australians. That cost-of-living data is trapped using other indexes called selected living cost indexes. These are produced for subsets within the economy based on source of income. The largest group is employees, comprising 15 million current wage and salary earners. This is more than 70 per cent of the Australian adult population. This index shows the rate of inflation affecting the largest cohort of the adult population in Australia is actually 6.2 per cent. That feels much more accurate than the official CPI rate of 3.8 per cent. Even at 6.2 per cent, the figure is not entirely representative. The living cost index for most Australians does not include the insane increases in house prices, as Senator Rennick and I pointed out in questions.

The ABS traps the increase only in building costs, not the increase in land cost. The average home price in Queensland in 2020 was $524,000. In 2024, it’s now $815,000. Most of that inflation is in the land price. Unless home price inflation is included in the living cost index then Australians are quite honestly being misled—badly misled. The ABS is not misleading; it’s producing the statistics the government asked it to produce.

So I wonder who decided to use the CPI rate as the official picture of inflation in Australia, because it’s wrong. Why don’t the media report the living cost index showing 6.2 per cent inflation affecting most Australians, and that it doesn’t represent costs including houses? All except one of these living cost indexes shows a higher rate than the 3.8 per cent CPI. Why is the media misleadingly reporting the lowest figure instead of the real figure covering most Australians?

I have been using adult Australians here for a reason. This inquiry confirmed the Australian Bureau of Statistics does not collect data for inflation affecting the cost of raising children. The latest data my office could find was from the Australian Institute of Health and Welfare, which found it cost $340 a week to provide for two children, a girl aged six and a boy aged 10. That data was from 2018. We don’t know what it is today. There’s not time-series data, no inflation rate over time for children and that seems pretty poor. There are 5.7 million children under 18 here in Australia. It would be useful to know how much the cost of raising those children is increasing.

As I travel around Queensland I hear so many parents saying how expensive life is becoming—the cost of living under Labor—and how expensive raising children is becoming. The failure to provide data to government on the outcome of government policies on the cost of raising children and an accurate figure for the cost of running a family is a massive failure, a failure which rests with the minister, not the Australian Bureau of Statistics. I call on the government to task the ABS with providing an accurate figure for inflation affecting families. It worries me that it is the figure of 3.8 per cent, not the much more accurate figure of 6.2 per cent, that’s used for wage increases. According to the OECD’s economic outlook report, real wages in Australia are now five per cent lower than they were in 2020.

Remember, those house prices I mentioned, up from $524,000 to $818,000 in Queensland in four years? After adjusting for inflation, everyday Australians looking to buy their first home are trying to afford that mortgage on five per cent less income. No wonder homeownership seems an impossible dream for young wage and salary earners. Wages should reflect the real cost of living under Labor. Government spending and handouts reduce the inflation rate yet this money started in the hands of employees, who paid that to the government in tax, and the government gives it back to people in subsidies, less the government’s cut for administration. Is this the much-touted Greens circular economy?

I’ll finish with an idea. Reduce the size of government. Let people keep more of their own money. If everyday Australians feel they’re working harder and going backwards, it’s because they are. I seek leave to continue my remarks later.

Leave is granted; debate adjourned.

Thank you – we need those like you who work for the people first

Not dissimilar to the unemployment figures! Totally inaccurate.

Thank you for pointing out that LCI inflation for the majority of residents is significantly higher than the CPI figures suggest.

My wage agreement includes a cost of living allowance (COLA). It is triggered when the scheduled annual pay rise is less than “CPI”. It’s no wonder they use the lowest figure for CPI – to avoid paying workers the COLA