Customers of Australia’s ‘Big Four’ banks are not getting a fair go.

The Commonwealth Bank announced a $10.2 billion annual profit made on the backs of the hard work of their customers and staff, who deserve better.

The Senate inquiry into bank closures in regional Australia has heard evidence of banks acting in concert, if not collusion, to close branches, forcing customers online and preventing the use of cash. Even with online banking unavailable in areas where bank branches close and despite their actions not serving their customers’ needs they’ve gone ahead with closures. Worse, the banks have misled the committee not only about their plans to close branches in the future, but even about the reasons why.

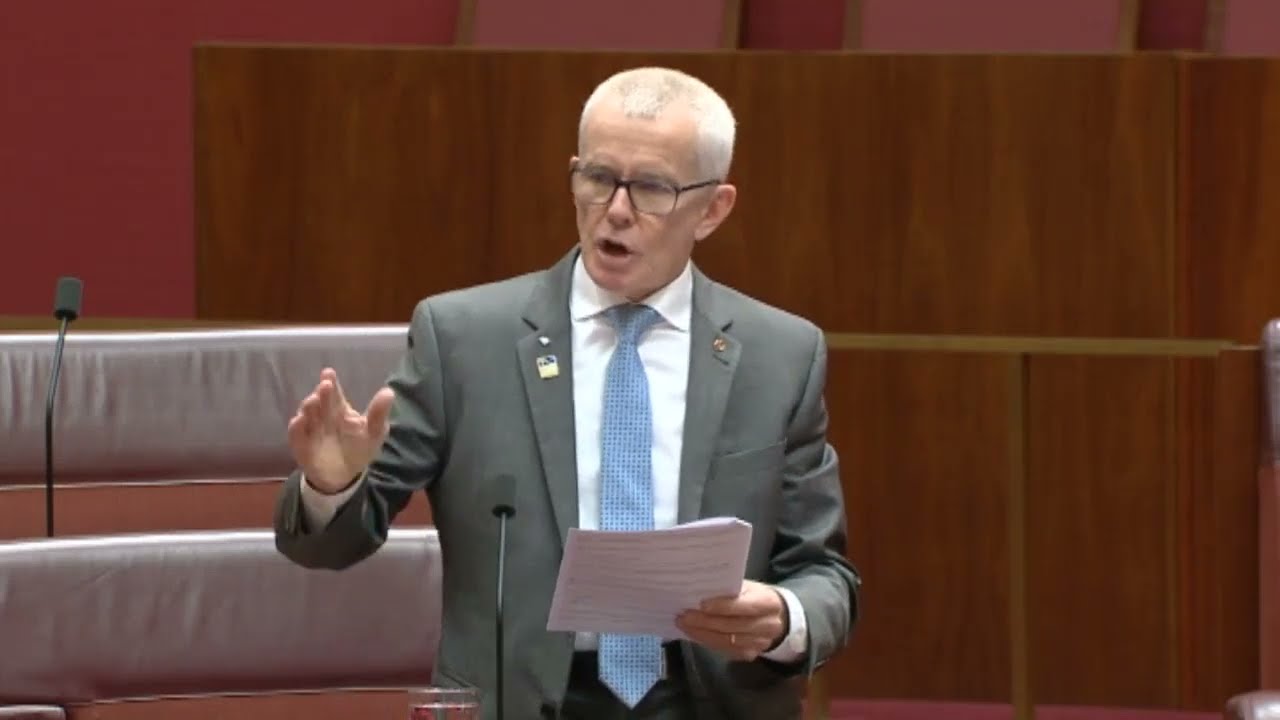

I will be addressing the reprehensible behaviour of the Big Four banks in the next sitting.

Transcript

As a servant to the many different people in our one Queensland community, it’s my duty to ensure that our constituents get a fair go. Customers of the big four Australian banks are not getting a fair go.

The Commonwealth Bank announced a $10.2 billion annual profit made on the backs of the hard work of their customers and staff, who deserve better. While the banking superprofits tax will return some of that excess profit to taxpayers, my question is: how are the big four banks able to exploit their oligopoly power to deliver obscene profits?

One Nation, of course, supports the right of companies to invest money and receive a fair return on investment—a fair return. One Nation believes that free market competition is the answer to providing all Australians with wealth and prosperity. Australia does not have free market competition in many industries, including in banking. We have an oligopoly conspiring together to rip off as much money as they can from captive clients. That was evident in 2017, when I chaired the Senate Select Committee on Lending to Primary Production Customers. The committee heard evidence of inhuman banking behaviour that screwed their own customers, taking homes, livelihoods, equity and even cattle, to which the banks were not legally entitled. No compensation has ever been made, because good luck suing a bank. Banks are above the law.

The Senate inquiry into bank closures in regional Australia has heard evidence of banks acting in concert, if not collusion, to close branches, force customers online and prevent the use of cash, despite online banking not being available in areas where bank branches closes and not suiting customers’ needs. Worse, banks have misled the committee regarding their future branch closure plans and misled the committee on the reasons for closures. The big four banks’ behaviour is reprehensible. In the next sitting, I’ll advance the debate regarding a proposal to stop banks further hollowing out the bush and forcing their customers into digital prison.

Watch this space.

Raising rates to slow inflation is BS the banks get richer and it’s slow to act.

Much better way would be to increase super, everyone sacrificed starting that week the result is immediate and shorter.

Can be increased rapidly and decreased rapidly but most importantly the money remains in the person’s account for later in life.

Don’t you think this would be much fairer?

Choralling people into ‘digital prisons’ is not something to be applauded. The lack of bothering to provide timely and appropriate service is a glaring slap in the face to all.

Senator Malcolm Roberts would you mind, also raising concern about credit cards and how come the interest fees are so far above the cost of borrowing.

Banks will say the cards are a separate entity to them, only badged to look like the bank.

Wouldn’t duty of care be split between the two?

Why are the card fees not reigned in? There must be a lot of individuals majorly stressed via the card interest compounding fees, at this moment in time.

Thank you for your efforts.

Malcolm, we need to ditch the whole fiat money system and the current bank robbery and CDBC.

Thank you for the way you CARE about the Australian people

If Banks like the IMF weren’t Laundering money in the first place and were held accountable to keep the customers physical money on site or stored in the vaults, people would use bank services , theft is theft. No legislation is lawful if it allows a criminal act to be commited. In the case if banks, under Common law , this would be seen as Grand Larceny, with aid of Government agents to transfer wealth and steal from the taxpayer who employs them. Its time this cartel was shut down. No more corporate governance and No cinsent to foreign interference of criminal cabals of the banking clans. Its time their wealth was stripped and redistributed back to the people they have stolen from for generations.

Not everyone has a credit card, so cash is still a needed commodity for many people in Australia. But the cost of credit cards is extortionate, with more and more people relying on them to pay their bills. I don’t begrudge corporates making a healthy profit, but I do begrudge them when they continually take and don’t give back. One of my pet hates – is the closure of banks in regional communities – and the removal of human teller services elsewhere. The elderly, for example, have difficulties navigating teller machines in the absence of human tellers. And then there’s the safety risk of scammers and robbery when using the machines out of hours. Most of the machines are located on street level and are vulnerable, with the banks refusing to help those scammed or robbed, yet the banks are creating an environment where this can happen. It is so wrong on so many levels.

The Commonwealth Bank should never have been privatized. It cannot be undone, but at the very least it should be stripped of its name, as it’s no longer a commonwealth entity, and it certainly has no interest in the common weal.

Perhaps its time for a new publicly owned bank?

AS Senator Roberts and party propose – Oz Bank in the Post Office.

I don’t know about everyone else but I’m getting sick and tired of banks ripping their “customers” off with fee after fee after fee!

I have suddenly awoken to how we get punished with transaction fees, normally absorbed by the merchant, now being passed onto the ever suffering public.

I refuse to pay anymore of these greedy bank fees, these fat cats already make billions in profit with OUR money and then charge us for using the very thing they introduced to be a convenience for, not just us but, THEM!

For gawd sake, all these transactions are completed by a computer in seconds, so where do these greedy bastards get off charging us more and more, just so their profits keep growing!

That’s it! I’ve had a gutful!

Time to go back to using cash!

See how these fat cats like counting and dealing in real money, instead of the digital kind!

This doing away with cash is designed to take away the consumers right to freely spend their own money, and will lead to a social credit scheme similar to the CCP where they control your money. Step out of line and there goes your bank account just as Trudeau the Canadian Commo did to the Truckers in Canada. And who could forget what the banks did to Nigel Farage.