The government’s lies about how many foreigners are buying houses during a housing crisis are coming back to haunt them.

Firstly, the government claims ‘foreign buyers are barely making a dent in the market’. The truth? 11% of new houses in Australia were bought by foreigners (Q4 2023). Secondly, ‘foreign buyers only go for luxury homes’. Reality: the average price of a home bought by foreigners is almost the exact same as the average house price across capital cities. That means foreign buyers are directly outbidding average Australians for an average house. Thirdly, despite saying the don’t make an impact on the housing crisis, the government is now implementing small fines for vacant homes.

Why does the government go through all of this deflection and lying when they could just take One Nation’s policy: BAN Foreign Ownership completely.

That’s just the problems with foreign ownership of housing! Never mind the next topic I asked about: letting a foreign company takeover Australia’s military warship builder…

Does this government understand anything about putting Australians first?

Transcript

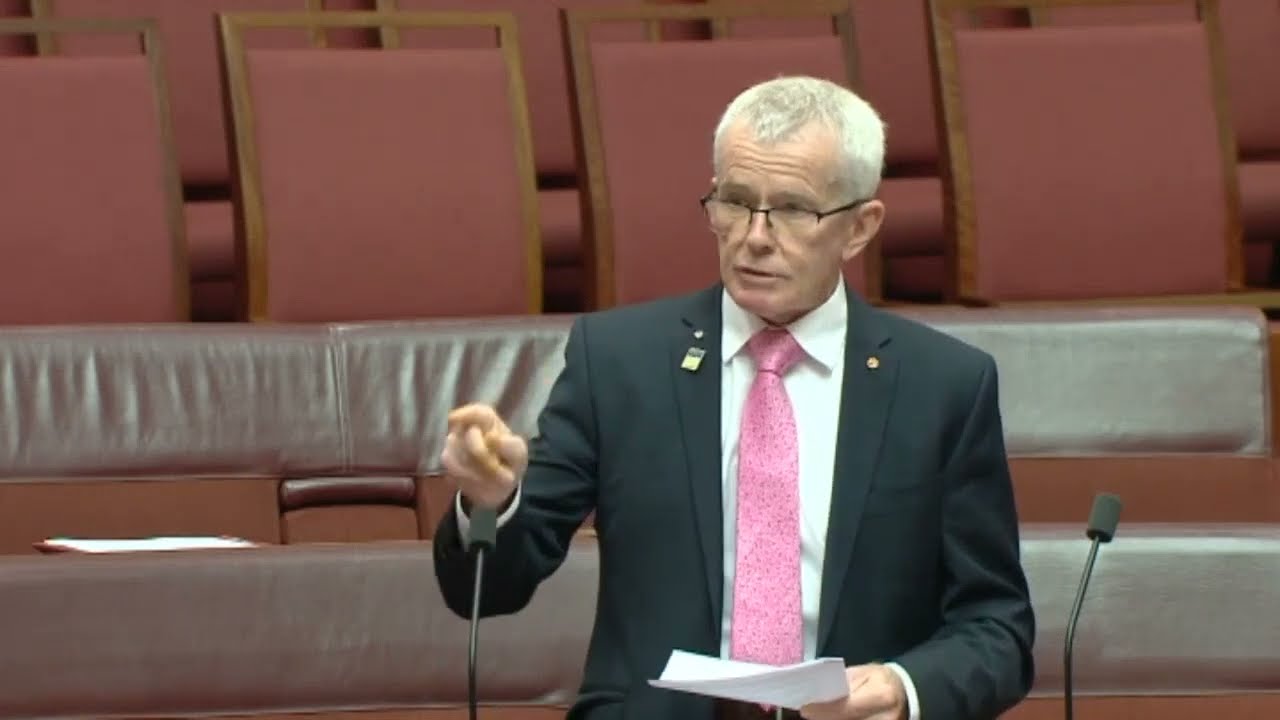

Senator ROBERTS: I’d like to table the transcript of a broadcast by Ben Fordham. Reporting from radio station 2GB indicates that foreign buyers bought 11 per cent of all new housing stock in this country. How are you letting this many foreign buyers snap up houses out of the hands of Australian homebuyers?

Ms Kelley: As we’ve talked about previously, our latest statistics show that foreign investors purchased around 5,360 houses in the 2022-23 financial year.

Senator ROBERTS: It’s been claimed by some that foreign buyers don’t make a material impact on the average Aussie because they’re only buying trophy homes—$30 million mansions down at Point Piper and so on. Looking at the $5.3 billion for 4,700 properties purchased by foreigners, according to these figures, that’s an average price of $1.1 million. The combined capital cities average median house price is $1 million. Those foreign buyers are actually directly competing in the middle of the market, aren’t they?

Ms Kelley: I should note again that the level of foreign investment in residential real estate is under one per cent of the total purchases that occur in Australia. In terms of residential properties with values under $1 million, that accounted for about 78 per cent of the purchases.

Senator ROBERTS: Minister, your government is increasing the fines and fees for foreign buyers of Australian houses. You’re acknowledging that it needs to be controlled. Why don’t you just stop fiddling around and ban foreign ownership of Australian houses altogether, like we’ve advocated, like the Canadians are now doing and like the Kiwis are now doing?

Senator Gallagher: We welcome foreign investment in our country. It plays an important role across our economy. But those changes we have announced to foreign investment, both for the application fees and double vacancy fees, are about ensuring foreign investment aligns with our agenda to lift housing supply. It’s aligning it with the other work we’ve been talking about this morning in Homes for Australia.

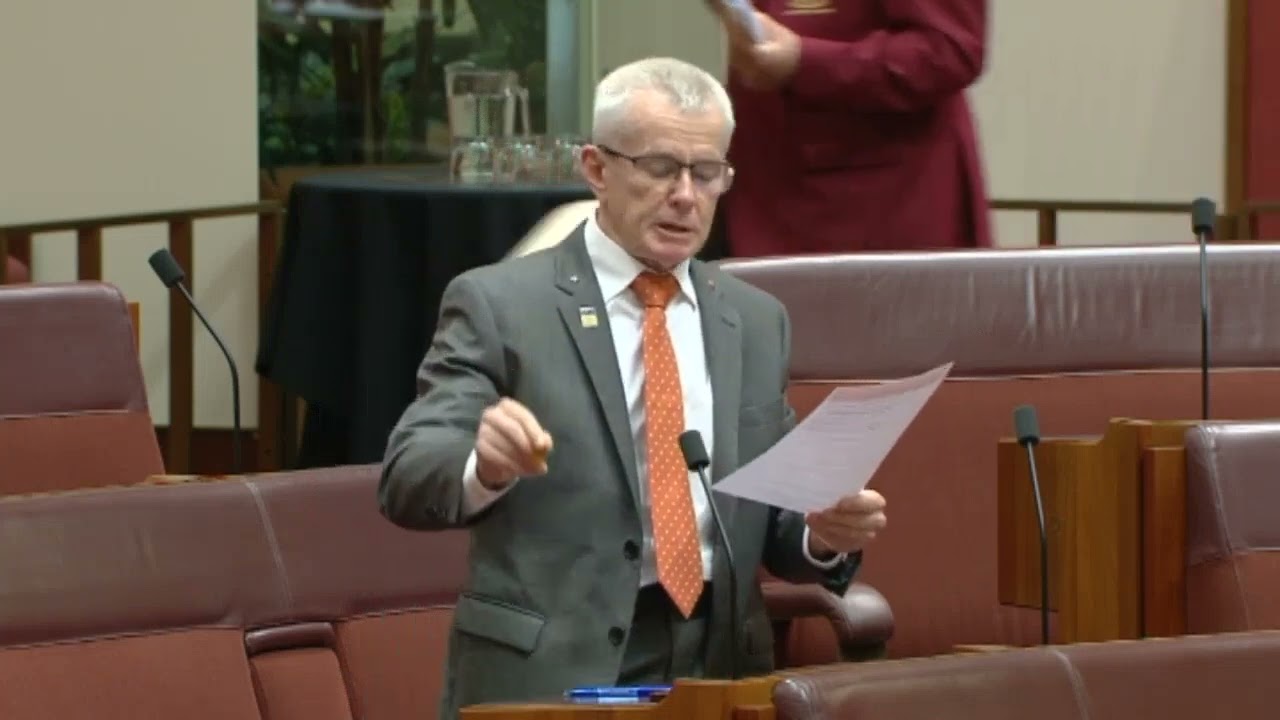

Senator ROBERTS: Working families who are returning home at night to sleep in their car won’t be encouraged by that. But let’s move on. How does the Foreign Investment Review Board treat defence-related companies in its approvals? If a company is producing a defence-related product, how is it treated?

Ms Kelley: The foreign investment review framework takes a case-by-case risk based approach. On 1 May the Treasurer announced a range of reforms to the framework. Under that framework we were very clear about the areas we would scrutinise more strongly. The government has made some decisions around those areas, and we are now actively implementing them.

Senator ROBERTS: It doesn’t sound like being a part of the defence industry enlivens a specific criterion in your approval process.

Mr Tinning: Yes. If it’s a national security business, which includes defence industries, then it’s subject to a zero-dollar threshold under our framework. So all foreign investment approvals—

Senator ROBERTS: So shipbuilding would be part of that, if they’re building defence vessels?

Mr Tinning: Correct. That’s right.

Senator ROBERTS: Do the current rules ever allow you to approve the sale of a sovereign defence industry asset to a foreign buyer?

Ms Kelley: That would depend.

Mr Tinning: As Ms Kelley said, it’s on a case-by-case basis, so we would need to see a specific application.

Senator ROBERTS: Why would we ever allow that?

Ms Kelley: As the minister has said, foreign investment is essential to our domestic economy and has been for decades. What the framework does is—we assess every foreign investment application in terms of our national interest and in terms of national security.

Senator ROBERTS: I understand that the potential sale of Austal to a South Korean bidder, Hanwha, had pretty much fallen off the radar. Then Minister Marles reignited it by saying, ‘I don’t see why there’d be any concerns.’ Does the defence minister’s view factor into your assessment at all—that the sale of Austal, the company that builds Australia’s warships, wouldn’t be a problem?

Ms Kelley: We take into account a range of factors when foreign investments are assessed, and the national security aspects are very important. We liaise across government for views on the issues associated with a foreign investment application and then the advice is then put forward to the Treasurer for a final decision.

Senator ROBERTS: Minister, why would the defence minister say that the sale of Austal, the company that builds Australia’s warships, wouldn’t be a problem? He’s the defence minister and he’s looking at selling a maker of some of our warships.

Senator Gallagher: I haven’t seen those comments, but the defence minister would be very well briefed on all matters relating to that.

Senator ROBERTS: I’ll come back to the Treasury after the opposition asks questions.

Your work is much needed and much appreciated

Everything Labor does has a reason behind it . This business of pulling the carpet out from under home buyers here to sell for a higher profit to foreign buyers brings Australians to their subservient knees while we still pay them their big fat salaries . It will attract more foreign ownership to the point where the rich comfortable residents who already have priority over Australians in most part will end up owning this country . It was said many years ago that Australians were becoming 2nd rate citizens ,,,, well now it’s gone beyond .

I am a person who Designs houses for so called Clients who then sell them on to Over Seas investors. In SE Qld it is All people from over seas buying the stuff. They then don’t rent them out But keep them for Their people getting here……This MUST STOP!!!!!!!!