The government is promoting their Help to Buy scheme where they will own 30-40% of your home (instead of you). While it might sound good to Australians desperate to get into a house, the details are terrifying. One of those details that didn’t get much media attention was the structure of the mortgage. Government won’t be a co-owner of the house, they’ll be a second mortgagor. That means they are behind whichever Big Bank gives you the main mortgage.

This is bad news because if house prices go down at all (they are currently at record highs) the Big Bank gets first priority to recover all of their losses, leaving the homeowner and the government (aka taxpayers) out of pocket. That means the banks will probably be getting risk free profits at our expense. This is just one of the many problems with “Help to Buy” which means it won’t help at all.

One Nation has the real solutions to the housing crisis. Start with cutting record immigration, banning foreign ownership and letting tradies do their job, not pumping up Big Bank profits.

Transcript

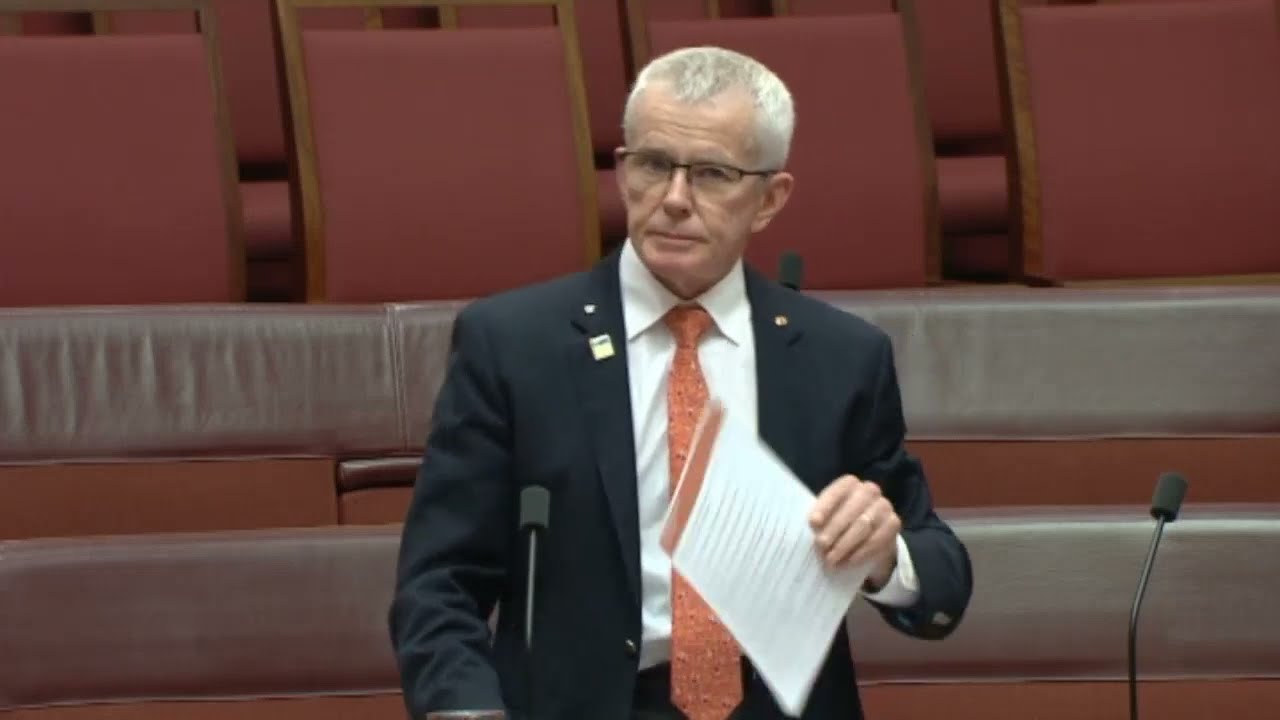

Senator ROBERTS: Thank you, Minister. Just to confirm, the bank or the lender would be the first mortgagor and the government would be the second?

Senator AYRES: Yes, that’s exactly right, and there are, of course, other arrangements that people have in the private sector that that will look very similar—that is, for the participant, the relationship with the approved lender and the second mortgage will be exactly the same as other Australians have, but there will be a lower mortgage threshold and lower repayments for that group of Australians who satisfy the criteria.

Senator ROBERTS: In the event of a default or price fall, is the bank entitled to recover its losses before the government does? That would seem to be the case.

Senator AYRES: Yes. Just like in an arrangement that you might have or any other Queenslander might have with their lender, there are shared risks and shared benefits.

The “Help to Buy” policy STINKS !

It is designed to increase demand and push up house prices.

Malcolm’s right, a big cut to immigration will reduce demand .

Banning foreign residents from owning Australian residential property will reduce demand and increase supply if foreign residents already holding Australian residential property are forced to sell.

Australian residents will then have a better chance to buy.

Hi Malcolm,

Re your issue with Banks having first call on Mortgagees. You do realize that what you said applies to all Mortgagors don’t you? If the Bank calls in a Morgage and sells it the amount received after selling expenses goes to the Bank. That is why all residential mortgages require Insurance cover. It is called Mortgage Insurance and every loan in Australia has it. If your deposit is more than 20% of the purchase price, then the Bank pays the premium for you. If it is less than 20% then the purchaser pays the Premium. The mortgage Insurer pays the Bank of any shortfall between the sale price and the mortgage balance. At least up to whatever the amount of the insurance cover was.

If that Insurance cover did not exist, then the seller, who is already in a bad financial position, would have to pay and obviously they probably can’t. So doing it this way is beneficial to the seller and the Bank. It is not something to be saying is a terrible thing. I note that the Mortgage Insurer has the right to recover the amount above the insurance they paid to the Bank. But at least the seller gets time to get the Bank off his back and pay it off over time. .

Surely what you could do is arrange with financial people to let you know how to help people prior to committing to large mortgages? IN my experience, it is always financially illiterate people who get caught. And while Banks have a system to calculate the maximum a couple or individual can borrow, it is people’s situations that change and bring about woe. Such things as Income Protection can be of help or Death cover or Temporary and Permanent Disability cover can also help. These can be purchased through someone’s Superannuation to avoid additional expense to someone’s cash flow.

Other things are of importance and should be discussed. These things are far more important than Bank bashing which achieves nothing.

kind regards,

Peter Connolly.

Hi again Malcolm,

Couple of things for you. A Bank or the person/entity who lends the Money for a mortgage is known as the mortgagee. The borrower is known as the mortgagor. Note that the word mortgagor has an “O” in it as this person “owes” the money! A good way to be accurate!!.

I note Senator Ayres said the threshold for mortgages is lower for both the borrower and the Government with these loans. That is a good thing as it reduces the risk of default because the repayments generally are easier to make as they are less. That’s a smart move by the Govt.

It also means that if the Gov is being limited on how much it can borrow and sign off as 2nd Mortgagor, then the purchaser needs a decent size deposit which also reduces risk. I note that as a deposit increases, then the amount of borrowing lessens. I have not seen any specific numbers around this, but would like to. Can you help?

kind regards,

Peter Connolly.

Nothing surprises me about the Australian government . Maybe if they keep it up immigrants will pick up on it and decide they don’t want to live here either .