How much has your insurance increased? For some, insurance costs have increased by as much as ten times. While many insurance companies operate under Australian brands, they are actually controlled by foreign multinational investment funds like BlackRock, Vanguard, State Street, and Goldman Sachs. These foreign entities influence our government to push climate change propaganda, which they then use as an excuse to drastically increase insurance premiums.

Only One Nation can be trusted to say no to the foreign corporate cartel, ensuring more affordable insurance for Australians.

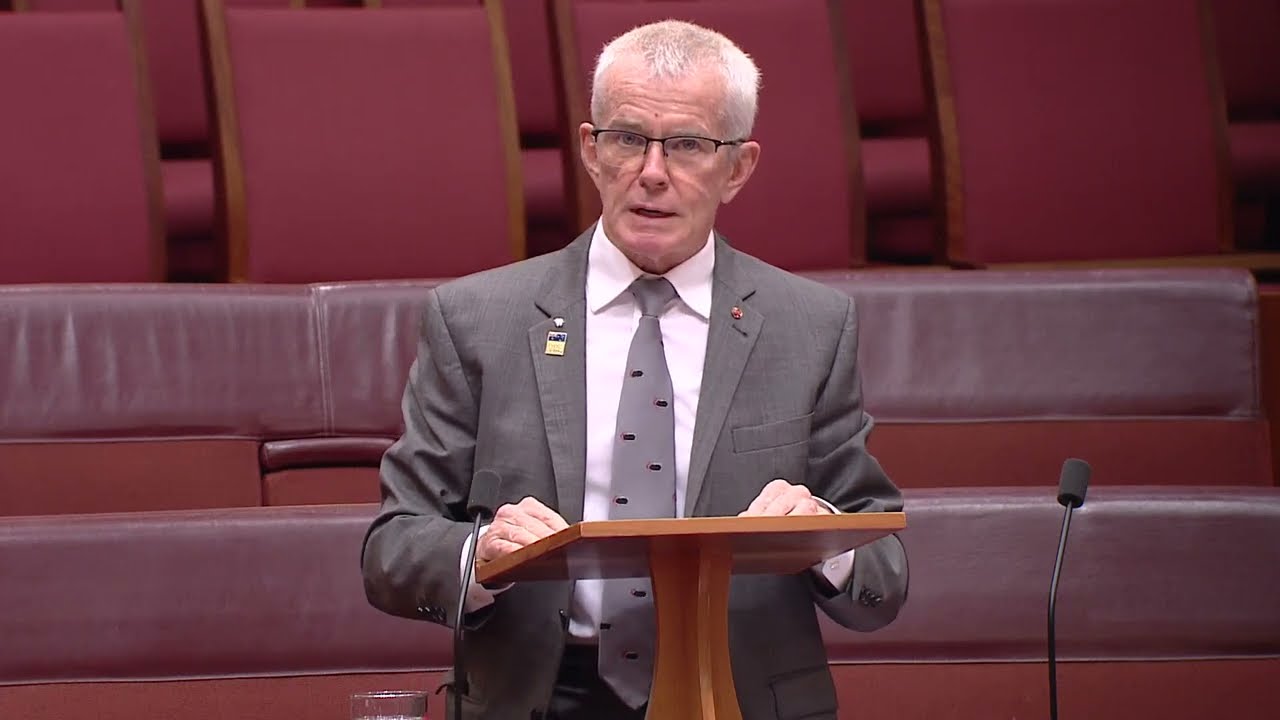

Transcript

My question is to the Minister representing the Minister for Financial Services, Senator Gallagher. Minister, Australians opening insurance renewals have been falling off their chairs. Brendan O’Malley from the Courier Mail reported in September that a homeowner on Cheviot Street in Brisbane had their insurance bill increase from $3,000 to $32,000 a year—more than 10 times. Queensland’s Suncorp Bank profited $379 million last year, while Suncorp Bank’s insurance division made a whopping $1.2 billion profit, more than triple that of their banking business. Why is your government letting insurance companies rob Queenslanders?

Senator GALLAGHER: I don’t accept the proposition that Senator Roberts has put as part of his question. But I do accept and understand that insurance affordability is a real issue for Australian households and businesses, and it is something that the government is concerned about. You see in the inflation data that one of the big drivers of inflation is the costs around insurance. There are a number of reasons insurance premiums have increased in the last 12 months—it’s due to a range of factors—but I think Senator McAllister was talking about this earlier in the week. There have been more frequent and more intense hazard events, price inflation is making it more expensive to repair damages, and there is the global distribution of risk by reinsurers, which are having to cover the costs of earthquakes in New Zealand and hurricanes in Florida—that all has an impact on costs here. The government has established an Insurance Affordability and Natural Hazards Risk Reduction Taskforce within PM C to address the impacts of climate change and inflationary pressures that are driving up the cost of insurance. We are looking at what further steps the government can take, working with industry and stakeholders through the taskforce, including some things the insurers always raise this with me: risk mitigation, land use planning and other near-term opportunities to address affordability.

The PRESIDENT: Senator Roberts, first supplementary?

That insurance bill that I talked about before went up because Brisbane City Council published new climate scaremongering flood maps. The street never had a problem with flooding yet was included in a new zone marked for a one-in-2,000-year climate change doomsday flood. Minister, why are you letting insurance companies use baseless climate change scaremongering as an excuse to gouge billions at the expense of Queenslanders?

Senator GALLAGHER: As I said in my previous answer, there are a range of drivers impacting on the cost of insurance. Some of it is around local hazardous events that we’ve had, including floods, and including floods in Brisbane and other areas of Queensland. But there are other reasons, like price inflation and like the reinsurance market, which is being affected by those big, global natural disasters that we’ve been seeing. Some would say—and I would say—these are caused by climate change. I accept that you might not agree with that. In relation to land use planning, that has been subject to a number of inquiries and reviews post the flooding, particularly in areas like Brisbane. Land use planning zoning maps have changed to reflect some of the risk associated with that, and that would feed into premiums not just in Queensland but around the country.

The PRESIDENT: Senator Roberts, second supplementary?

Foreign insurance companies own these insurance companies in Australia. Foreign multinational, global wealth funds and corporates like BlackRock, Vanguard, State Street and Goldman Sachs are the largest and control shareholders. Insurance is expensive, and the money goes overseas. Minister, why aren’t you doing anything to stop these insurance companies gouging Queenslanders and sending the profits overseas to multinational, global investors?

Senator GALLAGHER: Certainly, I’ve already alluded to the fact of global distribution of risk by reinsurers. You talk about them. The global reinsurers affect the price of insurance here, as they do in other countries around the world. But I do not accept that we are not taking any action. We have established this taskforce to look at what further steps we can take to build on existing work, including in areas like risk mitigation and land use planning, as well as other steps to deal with some of these affordability challenges. This is a challenge not just in Queensland but around the country.

I’ve ditched my business insurance. Way too expensive for little coverage.

Insurance-No wonder people can no longer afford to buy insurance, just add on the rates for normal homeowners. We are farmers we own old scale less than 600 acres and our rates are just over $50,00.00annually. This would pay for new iron for our sheds or other much needed items. We are all being used as cash cows to the point of extinction. Where is this going to end? We know the government is the cause of inflation while we tighten our belts again and again. would like to do

Thank you for your persistence for good – for all Australians. It is both needed and much appreciated!

I can remember when insurance premiums remained the same even when storm , floods , bushfires destroyed properties and homes,,, reasons why is because they have what is called a ( contingency fund ) . These days they still have these backup accounts except they tell you when bushfires & floods destroy lot’s of properties premiums have to go up to cover the costs due to increased claims ,,,,,!

So now whenever there’s a natural catastrophe it’s their immediate reaction to increase our premiums

Insurance companies are resorting to dirty business due to greed and corrupt foreign ownership . Where’s the law to monitor this ?

Would it help to publish a list of Insurance company owners? And then maybe we could all promote the ones not conected to the foreign companies.

100% correct. Lots of families are forgoing building insurance in QLD. One family we know said their building insurance is now $8,000.00 pa—they’ve had to cancel it. It’s a third world when families can no longer afford to insure their biggest asset—the family home. But that’s the globalist agenda — own nothing and be happy.