Reserve Bank Governor Michelle Bullock was appointed to the position after a 20-year career in the Reserve Bank, including being the recipient of subsidised housing loans despite her substantial salary. Her early comments were reflective of her being “a long time in the public service bubble” and were out of touch with the hardships faced by everyday Australians due to past Reserve Bank policies causing high inflation and interest rates.

Her recent comments, however, appear to be much more in tune with understanding everyday Australians’ concerns.

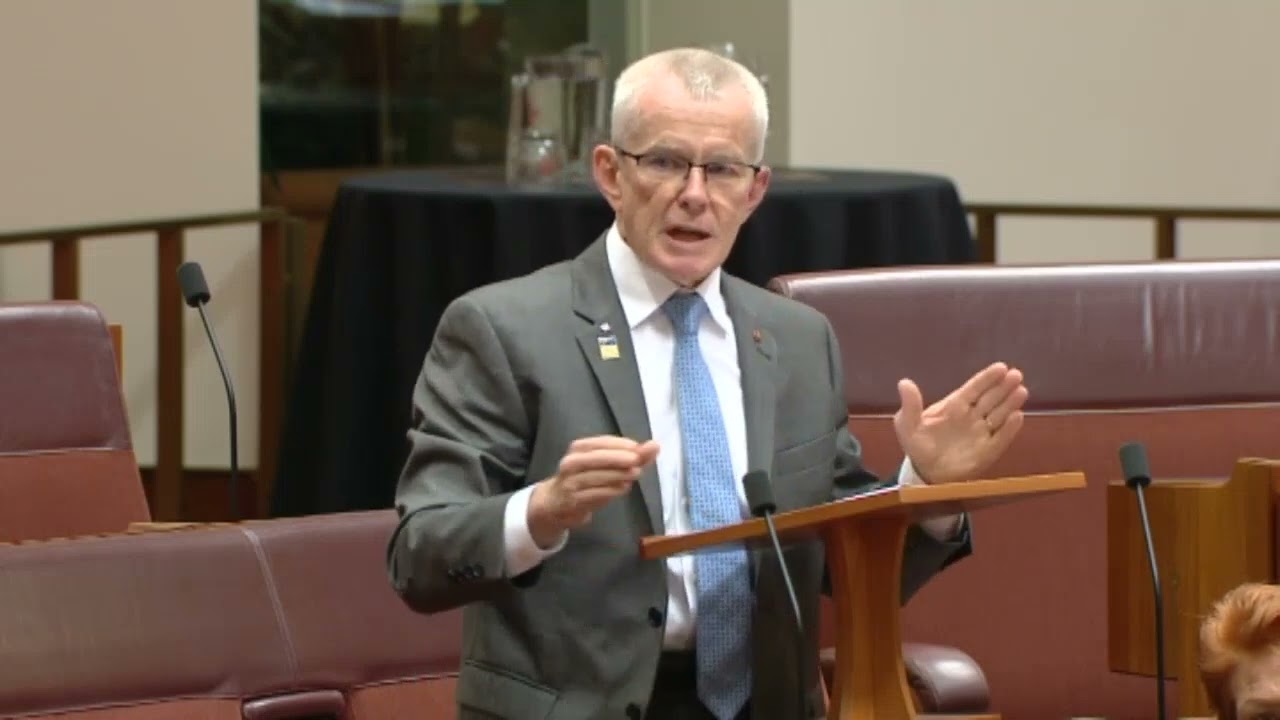

At Senate Estimates, my questions were aimed firstly at getting updates on less reported projects and secondly, I wanted to know whether the Governor realised her role is about people not spreadsheets.

I found her responses encouraging and look forward to more people-oriented management from the Governor going forward.

Transcript

CHAIR: Thanks. Senator Roberts.

Senator ROBERTS: Thank you for appearing. I missed you last time because I couldn’t get on the schedule. I want to get a quick update on as many things as possible. Part of the Reserve Bank’s process is to review inflation data and unemployment data. Do you use data from the ABS and, if so, do you use that data exclusively, or do you have other sources for unemployment and inflation data?

Ms Bullock: We use ABS data obviously for inflation and unemployment. We use a variety of other sources of information, though, because we don’t just focus on the unemployment rate itself; we focus on a variety of measures that the ABS put out. We also focus on things like vacancies and advertisements. There’s information we get from our business liaison program, where we talk to businesses about what they’re doing with their labour forces: are they demanding more labour or not? So we use the ABS data, but we have a wealth of other information that we look at as well.

Senator ROBERTS: Thank you. Business-to-business payment defaults and business bankruptcies, to the third quarter of 2024, are at a record. I’m sure you know that. Are you watching these metrics? And would these record figures act to reduce the appetite in the Reserve Bank for another interest rate rise?

Ms Bullock: We do watch the business insolvencies data. My understanding is that they haven’t actually returned to the trend that they were prior to the pandemic. In the pandemic, with low interest rates and government assistance, insolvencies were actually at a record low. They have popped up, but they haven’t popped up to where the trend was going prior to the pandemic. So I think that’s important perspective to put it in. We do look at it and we look at it from a couple of perspectives. We look at it from the perspective of how monetary policy is impacting businesses, but we also look at it from the perspective of financial stability and the potential impact on banks, banks’ arrears and banks’ balance sheets.

Senator ROBERTS: Thank you. Suicide Prevention Australia’s community tracker, also to the third quarter of 2024, shows a huge rise in the number of calls to help services, in suicidal behaviour and in clinical presentations. This is an independent and accurate barometer of how everyday Australians are doing. Are you aware of that tracker?

Ms Bullock: Yes, I am. In fact I have regular meetings with various organisations—for example, Beyond Blue. They talk to us a lot about this sort of data. We also talk to ACOSS regularly, we talk to other charities in our business liaison program and we hear a lot about the fact that charities are seeing people come in who they haven’t seen before. So this is obviously an indication that they’re stressed. So, yes, we do keep in touch with that stuff.

Senator ROBERTS: Can you update me on the state of the central bank digital currency, please? The last word we had was I think when Mr Debelle was deputy governor. I understand you’re developing a standard, not an actual currency itself? Is that correct?

Ms Bullock: We’ve done a couple of things. We ran a pilot program with a real claim on the central bank last year.

Senator ROBERTS: Is that what’s known as a ‘sandbox’?

Ms Bullock: It was sort of like a sandbox, if you like. We had a number of different use cases. Various businesses came in with their use cases to use the central bank digital currency. From that information, what we took away was that probably the most fruitful piece of research we could continue with was the use of a central bank digital currency in a wholesale sense. By that I mean there’s a lot of discussion about putting assets on the ledger—for example, having a distributed ledger of financial assets—and then you could have a central bank digital currency which is used to make settlements of those financial instruments, or they might be physical instruments, physical assets. That’s the most fruitful work and that’s where we’re going at the moment. We’re in the process of standing up a project that looks at how a central bank currency could be used in the atomic settlement of assets. That’s where we’re going at the moment.

Senator ROBERTS: So you’re not developing a standard?

Ms Bullock: No. Basically, we’re looking at what the business case might look for. We’re not so interested in the technology and we’re not so interested in standards. What we’re interested in is: is there a business for this?

Senator ROBERTS: Would that allow other parties, including each of the banks, to develop their own cryptocurrency?

Ms Bullock: The banks themselves can develop what some people call ‘stable coins’, and some banks have developed stable coins. Central bank digital currency, if it were to be developed, would be something that everyone could potentially use—not literally every Australian, because, if we’re focusing on business, then it might be that some businesses can use it. Individual banks can, in theory, at the moment—and some of them have experimented with it—develop stable coins, which are effectively cryptocurrency. CHAIR: It’s your last question, Senator Roberts.

Senator ROBERTS: This would not exclude existing cryptocurrencies, such as bitcoin?

Ms Bullock: No. The central bank digital currencies would not have a relationship with bitcoin, no.

Senator ROBERTS: But it wouldn’t exclude bitcoin?

Ms Bullock: What do you mean by ‘exclude bitcoin’?

Senator ROBERTS: To sideline them or remove them.

Ms Bullock: No, bitcoin would continue to exist, but central bank digital currencies offer a different business proposition than bitcoin. Bitcoin has particular uses; central bank digital currencies would not be encroaching on that space, I suspect.