I talk to author and activist Ellen Brown on banking, debt and the need for a people’s bank.

Ellen Brown is an American author, attorney, public speaker, and advocate for financial reform, in particular public banking.

She is the founder and chairman of the Public Banking Institute, a nonpartisan think tank devoted to the creation of publicly-owned banks. She is the author of thirteen books and over 350 articles published globally.

Ellen began her career as an attorney practicing civil litigation in Los Angeles. Her interest in financial reform was sparked during 11 years spent in Africa and South America, where she began to explore solutions to the challenges of the developing world. She researched the private banking cartels, their hegemony over Wall Street and control of the Federal Reserve. She also looked at public banking, which she discovered is a very successful model. The only operating state-owned public bank in the United States today is the Bank of North Dakota and has been touted as outperforming the big Wall Street banks.

In 2007 Ellen published the first edition of her best-selling book Web of Debt (now in its 5th edition). The book details how the private banking cartels have usurped the power to create money from the people themselves and how the people can get it back. Her writings proved prescient, as the financial collapse of 2008 laid bare the systemic problems she had identified.

In her 2013 book The Public Bank Solution, she traces the evolution of two banking models that have historically competed—public and private—and explores contemporary public banking systems around the world. Her latest book is Banking on the People: Democratizing Finance in the Digital Age (2019).

The Web of Debt is one of the best books I’ve read. Ellen is a dynamic woman with considerable energy and extraordinary research skills. Amazingly, much of her research was done painstakingly before use of the internet became widespread.

Transcript

Speaker 1:

This is the Malcolm Roberts Show on Today’s News Talk radio, TNT.

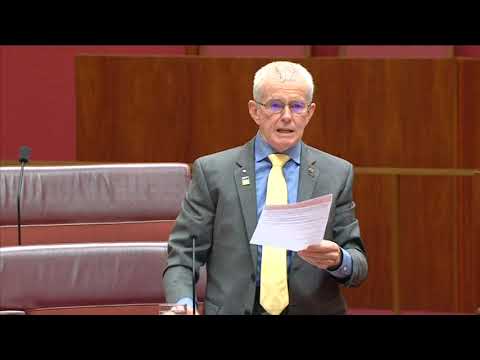

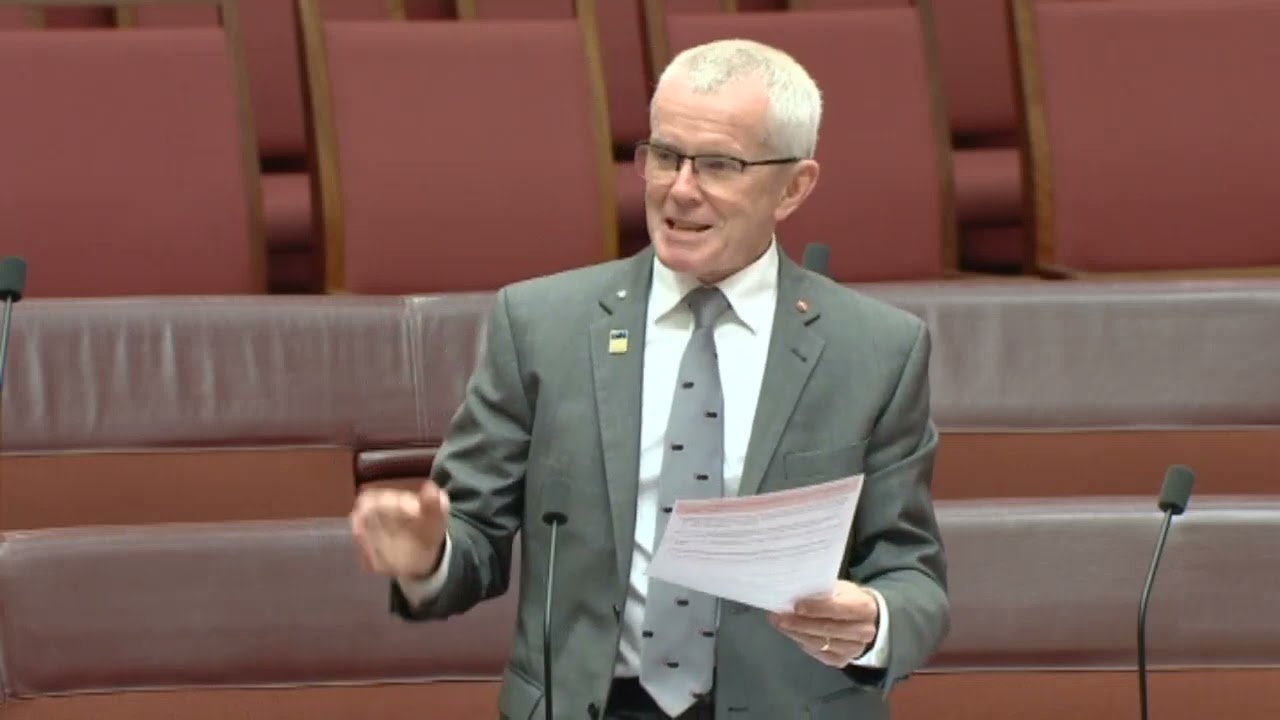

Malcolm Roberts:

This is Senator Malcolm Roberts. This is Today’s News Talk radio tntradio.live. I want to thank you for having me as your guest, whether it’s in your car, your kitchen, your lounge, your shed, or wherever you are right now. As regular listeners understand there are two most important themes for my programme. Firstly, freedom and specifically the age old freedom versus control challenge. Secondly, personal responsibility and integrity. Both are fundamental for human progress and for people’s livelihoods.

Malcolm Roberts:

On this show, we’re going to talk about money, money, money. We’re going to cover the eighth and final key to human progress. So I’ll list those eight keys to human progress. The first is freedom, the second is rule of law, the third is stable constitutional succession. The fourth is secure private property rights. The fifth, sorry, I’m losing track of counting. The fifth is strong families, sixth affordable, efficient, reliable energy.

Malcolm Roberts:

Then we did the next one last time, which is taxation. And this one, the eighth key is honest money. Now I’ve just introduced the word there honest money. We’re going to learn today from international and Australian experts about something we all take for granted. That’s right money. Think about it. It’s intimately involved in almost every aspect of our lives yet we take it so much for granted that we don’t see where it is, where it comes from. And we are living in misery at times. So many people living in misery.

Malcolm Roberts:

I’m going to refer to a quote from my website on the CSIRO looking at what’s pushing the global climate scam, but I’m going to quote from Ellen Brown’s book, where she’s referring to Louis McFadden, who is a senior member of the American House of Representatives, quote, “In 1934, he filed a petition for articles of impeachment against the Federal Reserve Board charging the Federal Reserve Bank with fraud, conspiracy, unlawful conversion, and treason.

Malcolm Roberts:

Then I’m going to quote from his speech where he spoke of one instance of 60,000 home and farm owners losing their property to bankers at one stage of the great depression. Here’s what he said. Their children are the new slaves of the auction blocks in the revival of the institution of human slavery. A document that I referred to called the Bankers Manifesto of 1934 added weight to these claims from these charges from McFadden, an update of the banker’s manifestation of 1892. It was reportedly published in the civil servant’s yearbook in January 1934 and in the New American in February, 1934 and was circulated privately among leading bankers.

Malcolm Roberts:

It said in part, ‘Capital must protect itself in every way through combination monopoly and through legislation,” that’s controlling governments. “Debts must be collected and loans and mortgages foreclosed as soon as possible.” Now listen to this bit. When through a process of law, the common people have lost their homes, they will be more tractable and more easily governed by the strong arm of the law applied by the central power of wealth under control of leading financiers.

Malcolm Roberts:

People without homes will not quarrel with their leaders. This is well known among principle men now engaged in forming an imperialism of capital to govern the world. Now, Australian speaker and researcher, John MacRae cites the same quote independently via another credible publication. Note that the bankers rely on what they falsely refer to as the law yet they are in their dominant and powerful position due to supposedly legalised legislation past deceitfully and in breach of the American constitution in breach of the American constitution.

Malcolm Roberts:

Their position is legal in that it’s legislated yet it’s fraudulent and thus unlawful that enables the people to remove it using the law. So what I wanted to discuss today with two very credentialed people is covering the basics of what is money? What do banks provide? Why are they so powerful? Who pays for the transfer of wealth from people and businesses to banks? So we will learn today how money is not honest. And we will learn today what is honest money?

Malcolm Roberts:

My first guest for this hour is Ellen Hodgson Brown. She’s an American author, attorney, public speaker and advocate for financial reform in particular in public banking. She’s the founder and chairman of the Public Banking Institute, a nonpartisan think tank devoted to the creation of publicly owned banks. She’s the author of 13 books and over 350 articles published globally. Much of a research was done before the access to the web, the worldwide web. An amazing woman.

Malcolm Roberts:

Ellen began her career as an attorney, practising civil litigation in Los Angeles. Her interest in financial reform was sparked during 11 years spent in Africa and South America, where she began to explore solutions to the challenges of the developing world.

Malcolm Roberts:

That’s why I love people who look around and see what’s going on. She researched the private banking cartels, the hegemony money over wall street and control of the federal reserve bank. She looked at public banking which she discovered as a very successful model, a very successful model, it’s successful in Australia in last century as well. The only operating state-owned public bank in the United States today is the Bank of North Dakota and has been touted as outperforming the big Wall Street banks. Every year it’s made a profit since it started.

Malcolm Roberts:

In 2007, Ellen published the first edition of her best selling book, The Web of Debt and it’s now in its fifth edition. And I can thoroughly recommend that. I’ve read it. The book details, how the private banking cartels have usurped the power to create money from the people themselves and how the people can get it back.

Malcolm Roberts:

Her writings prove prescient as the financial collapse of 2008, laid bare the systemic problems that she had identified. In her 2013 book, The Public Bank Solution, she traces the evolution of two banking models that have historically competed, public and private, and explores contemporary public banking systems around the world. The latest book is Banking On the People Democratising Finance in the Digital age and it was published in 2019. The Web of Debt is one of the best books I’ve ever read. Ellen is a dynamic intelligent woman with considerable energy and extraordinary research skills. Welcome Ellen.

Ellen Hodgson Brown:

Well, thanks Malcolm. It’s great to be talking to you. I’ve seen you on some little video clips lately, and you’re doing great work there.

Malcolm Roberts:

Thank you very much. And I’d like to talk about your work today. We always start Ellen with something you appreciate. What’s something you appreciate anything at all?

Ellen Hodgson Brown:

Well, I appreciate all the ordinary things that everybody appreciates, family and friends and health, and I used to appreciate travel, but I haven’t travelled since COVID. I think one advantage or one good thing about these lockdowns and about crises in general is that makes you appreciate things that you used to take for granted, like being out in public and able to breathe without having a mask on your face, simple things, or being able to travel without jumping through a lot of hoops that I’m not willing to jump through.

Ellen Hodgson Brown:

But one thing I really appreciate is the computer. Because when I first started writing books, we didn’t have access like we have now. And I had two small children and I dragged these two kids up and down the elevators in the UCLA library with these great heavy books, xeroxing studies and you’d get them home and they wouldn’t be what you really needed or it would refer to something else that you didn’t have access to. And now everything’s just at your fingertips, which is quite amazing, a whole world of knowledge, plus the ability to see into other countries and what people are doing around the world and get a sense of you can travel without actually travelling.

Malcolm Roberts:

So I was filled with admiration for you. We’ve talked before you took part in the Senate hearings rather on lending to rural and primary production customers. And you did a marvellous job there. We’ve talked before on the phone, I’ve read your books. I was stunned that you’d done most of your research before the internet and now I’m even more stunned because you were carting two girls around with you wherever you went. How did you do that?

Ellen Hodgson Brown:

One girl one boy.

Malcolm Roberts:

One girl one boy. Okay, well I’ve got to be fair 50:50. How did you do that?

Ellen Hodgson Brown:

That’s the thing. It took a lot of legwork. So I never go into libraries anymore. It’s all just right there. I did see that there was somebody at the World Economic Forum said that the Metaverse is going to be more real to us than our real lives. Well, I hope not but that is sort of the computer is a whole world in itself with great depth. It’s censor, of course you can’t always be sure you’re getting real information, but it’s incredibly interesting.

Malcolm Roberts:

Well, I know you’re a very strong woman, a very determined woman. I’d like to explore that a little bit later on, a very strong human in fact. I don’t distinguish between men and women in that sense, women are incredibly strong. I asked you before we were putting this together a couple of weeks ago, your idea of what you’d like to talk about. And you said you only see one substantive pro question for you and that’s proposed questions about solutions.

Malcolm Roberts:

You suggested some. What can we do about our unsustainable unrepayable sovereign debts? The US federal debt is now $30 trillion, not counting unfunded future liabilities. Second question, what to do about inflation. Third question, how to make banks and banking work for the people. Fourth question, how to make national currencies honest? So they’re the questions I’d like to ask. But first of all, I think we have to define the problem. So let’s define the problem. Let’s understand the issue, which is the problem. So what’s money Ellen?

Ellen Hodgson Brown:

Well, economists say there are three critical factors in money, which is, it has to be a medium of exchange, a unit of account and a store of value. So virtually everything we call money today, doesn’t really qualify on all those points are not very well. Store value, that value keeps fluctuating. Well, even gold. I have some gold and I have some gold stocks and I totally think it’s a good idea but it does fluctuate a lot. And so it can go up $50 in a day. I think just from reading your email, I suspect you favour a gold backed currency, but it didn’t work in the 19th century. That’s why we went to Fiat money anyway. So there’s that. That’s one definition.

Ellen Hodgson Brown:

There’s M1, M2, M3, the way the Federal Reserve defines it or M0 to start with. So those are all different levels of how liquid the money is or how accessible. So M0, they get kind of confused together, but say M1 is cash, which is obviously very fungible and your bank reserve or your bank deposits. And then bank reserves are created by the Federal Reserve and you can’t actually spend those, but those are I think they’re called M0. Anyway, M2 is the larger circulating money supply. M3 they no longer even count it anymore, but it included all the shadow banking, which is unregulated forms of money. I just read that estimates are that there are $50 trillion in Euro dollars traded every single day. And these are totally unregulated. The Federal Reserve has no control over them, they’re called dollars but they’re not even really dollars. They’re Euro dollars means any dollars created outside of the United States. So it could be Japan or anywhere.

Ellen Hodgson Brown:

And they’re really just banking accounting. It’s an accounting thing where they’re basically creating credit and credits and debits that there’s no physical paper involved. Anyway, it’s a huge amount of money it’s in the shadow banking system, nobody knows for sure even how much it is. It’s certainly not transparent. It’s not trackable at all but it’s between banks. It’s legitimate. Apparently banks can’t operate without it. And I remember reading that on the gold system, the only reason it really worked was that you had a lot of credit that ways of expanding credit besides the gold, because there’s just not enough gold to do all the trades that need to be done.

Ellen Hodgson Brown:

Even if you take one single product, I think there’s [inaudible 00:14:31] was talking about this and he, he has a gold bug, but he said that to do like a hundred dollars product, you have to do many hundred dollars worth of credits because every producer in the chain of production operates on credit. So they have to pay their workers and materials before they get paid. And then the next step up also needs. So they would also need gold if we were only operating in gold. So you can’t do it in just one metal. The Euro Asian Economic Union that’s headed by Sergei Glazyev. I just wrote an article on that. They’re proposing a new monetary system where it wouldn’t be backed by gold in the sense of that you could take your dollars and cash them in for gold at the bank, which is what you actually could do in the 19th century.

Ellen Hodgson Brown:

And that’s what happened. That’s what went wrong in the 1930s to ’33 collapsed where people were rushing to the bank and trading in their dollars for gold. The banks didn’t have that much gold and they were on a fractional reserve system. So they only had a certain percentage of actual gold. So they ran out of gold so the banks then went bankrupt. So you’ve got to have credit on top of your gold in some way. But anyway, so the Russian system that is being proposed and that maybe our new banking system is, it’s not exactly backed in the sense of you can cash in your dollars for gold, but it’s measured against.

Ellen Hodgson Brown:

So it becomes a stable unit of value because it’s measured against a basket of commodities and currencies when I wrote Web of Debt, I was proposing that you could use the cost of living index. In other words, a basket of things that everybody uses. And then you could figure out what the value or how much it would cost in dollars, how much it would cost and pay us, et cetera. And that would be your exchange rate rather than what we have now, where exchange rates are easily manipulated by speculators that short sell the currencies. And we’ve had several crises over that. Anyway, so what money is, is very fluid.

Malcolm Roberts:

Wow. What an answer controversial, sorry your last word

Ellen Hodgson Brown:

And controversial.

Malcolm Roberts:

Controversial. I was just about to summarise it. I asked you a simple question, simple question. Money, what is it? No, no, you’ve done a brilliant job. It’s a medium of exchange, which enables people to exchange my work for someone else’s goods and someone else makes a different product. So he makes butter and he exchanges it with someone who makes clothes and she makes clothes. So it enables an exchange of… It’s a medium of exchange. So we have to have that. Otherwise, it’s back to barter system. And a medium of exchange enables us to specialise, which gives us efficiency.

Malcolm Roberts:

The butter maker will be far better at making butter than I will be. And I don’t have to have the dairy cattle to make the butter. Then you also said, it’s a unit of accounting. It’s a measure of an account. And then you also said, it’s a store of value. So wonderfully, clearly they’re the three things. And then you went on with how liquid the money is, the bank reserves, unstable, shadow banking, credit, fractional reserve, a stable unit of value, manipulated, speculators. It’s a real mess. It’s a real nightmare. No wonder people don’t take much interest in this because it’s so damn complex yet let’s try and simplify it before we get onto your-

Ellen Hodgson Brown:

Yeah, well, I should have… The most important thing and the most what you might consider fraudulent thing is that it’s not created by the government. Virtually all of our money is created by banks when they make loans, which I actually think is a good thing. We need a credit system and that’s a way to do a credit system. But the problem is who controls the banks? Who owns the banks? Who has first access to the money, which is called the can Cantillon effect. Whoever gets their hands on the money. First is most able to profit from it. So obviously the private banks, Wall Street, City of London, et cetera, they can create money on their books for their cl their favourite clients who may be one big cartel.

Ellen Hodgson Brown:

And so they have easy access to cheap money and they can raise the rates to whatever they want on the rest of us. So, anyway, there’s the problem is that money is created by banks. They do it by double entry bookkeeping. So if you go to the bank to take out a loan, let’s say you want to buy a house and you take out a loan for $500,000, the bank will write $500,000 on one side of its books just into your deposit account, your checking account. And you can now write checks on that. And on the other side of their books, they’ll write the same $500,000 as an asset because you have agreed to pay that back. You’ve signed a mortgage, et cetera. You’ll pay that back plus interest.

Ellen Hodgson Brown:

Whereas, on the deposit that they wrote on the other side of the books is a liability to them because when you pay your seller, if the seller is in another bank, then the bank will have to come up with that 500,000, which they probably don’t have. What they do is they borrow it somewhere. So they borrow it. It used to be, they borrowed it in the Fed funds market from each other, but they don’t do that much anymore although that’s the interest rate that the Fed is allegedly raising and that’s supposed to cure inflation, which it absolutely won’t right now under these circumstances. We know it’s not that kind of inflation. But anyway, so now I lost my train of thought.

Malcolm Roberts:

So what, what you’ve talked about now is there’s the way the banks create money. I’m not bragging here, but I went to the University of Chicago, which is in the city of Chicago, as you know and it’s won more Nobel prizes for economics and finance than any other university in the world anywhere. So it’s got a very good name for finance, and they never told us that. They never told us how they create money, who controls the money creation and what you’ve just said, I’m going to give you an example to back you up in a minute but what you’ve just said is that banks create money in the first place by ledger entries, journal entries. And I can confirm that because I asked the Deputy Governor of Reserve Bank of Australia, Guy Debelle, he was the deputy governor at the time.

Malcolm Roberts:

And I said, so what you’re saying is that money is created using journal entries. And he looked at me hesitated, and then he said, “Electronic journal entries.” So it’s created as some people would say, it’s not quite right, but it’s created out of thin air. And as you just said, the person who creates the money has the greatest control, but then these same people, privately owned banks, the same people control the Federal Reserve Bank, the same people determine interest rates. The same people determine the money supply, how easy it is to get money. So they really control the government. They really control the economy, don’t they?

Ellen Hodgson Brown:

Right. And also to confirm that in 2014, that the Bank of England came out in their first quarterly report and said contrary to popular belief, banks do not act simply as intermediaries taking in deposits and lending them out again. In fact, banks create money when they make loans. And in fact, they said that 97% of the money supply is created in that way. So that was confirming what used to be conspiracy theory before that. When I wrote about it, in Web of Debt, it was considered quite controversial but now everybody agrees. That’s how it’s done.

Malcolm Roberts:

So what we’ve got here is a money creation system that’s privately owned and privately controlled in large measure. And you wrote very glowingly of the Commonwealth Bank, Australia’s Commonwealth bank early last century. And rightly so, you did a very good job on that. However, it was a rarity. And so the Commonwealth Bank had to be killed because it provided competition for the private banks, Wall Street and the City of London banks did not like it at all. It held them accountable, it controlled the money and it had to go and both Labour and Liberal party governments over the last a hundred years have well until 1995, ’96, when Keating sold off the last of the Commonwealth Bank.

Malcolm Roberts:

It was destroyed over a period of about 70 years. And my next guest will explore that further. So money is important in an economy. It’s important to economic health. You’ve already talked about how we measure it. M1, M2, M3, M0, volume of money. You’ve talked about the fact that money is not honest. Money is controlled, so let’s go on banks. What’s their role in relation to money Ellen?

Ellen Hodgson Brown:

Well, as the Bank of England is confirmed they’re not merely intermediaries taking in money and lending it out again. They’re actually creating the money, which sounds shocking but actually we do need that sort of system. We need a credit system. The question is just who owns the bank and who controls the bank. As you’ve said, the Commonwealth Bank of Australia originally was an excellent model. We’ve had several quite good models too. Historically Alexander Hamilton’s original plan was to have that sort of infrastructure and development bank in the end, it wound up privatised over his objection. He didn’t think that stocks should be… Well, it was sold to foreigners over his objection. But anyway, that was the intention was sovereign money and sovereign credit. And of course the American colonists started out with sovereign money, which was original to them at the time, not counting the fact that the Chinese did it like about a thousand years ago.

Ellen Hodgson Brown:

But for Western civilization, anyway, that was unique that we didn’t have money. The colonies didn’t have money. And so it was the Governor of Massachusetts in 1691 I think who got the bright idea of paying his soldiers, but just by issuing these little receipts, which were considered an advance against taxes, which was the same system as the tally system which was done by the British from like 1100 to 1700, something like that where they would split a… Well, I hope I’m not getting too far out.

Malcolm Roberts:

No, no, keep going.

Ellen Hodgson Brown:

Okay. So in the tally system, they took a stick and notched it. So it was an accounting system and then they split the stick. And since no two sticks split the same way, it was foolproof against forgeries. So you could put the sticks together. So the government kept one half the stick, and then the payee kept the other, other half of the stick. And then those sticks circulated in the economy as money. And that’s basically the same thing that the American colonist paper money was, which was, and you’d pay it to somebody who had delivered goods or services to the government. So the collective body of the people acknowledged that this was a debt owed to this person or whatever. And then that paper would circulate in the economy and when tax time rolled around, you could use it to pay taxes.

Ellen Hodgson Brown:

We actually did that in California in 2008, but the problem was that the government, the local government wouldn’t take the money back in taxes. So it did work. It would work, it works as an advance, but you have to agree to use this to take it back. And that’s what does give it its value and stability and so forth. But anyway, it worked well for the colonists, except for the fact that it was a lot easier to issue the money than to pull it back in taxes. Because these are frontiers when they didn’t like the idea of taxes in the first place, they were kind of hard to nail down.

Ellen Hodgson Brown:

We didn’t have a computer system at that time. But anyway, it worked pretty well except that they wound up hyper inflating or over printing and devaluing the currency until the Pennsylvanians, the Quakers in Pennsylvania got the idea of forming their own bank. So instead of just printing money and spending it, they printed money and lent it to the farmers. So that’s the ideal. That was the first US public bank was this the Pennsylvania state or colonial bank where they printed money, lent it to the farmers at 5% interest, which at that time was a quite good interest rate. And then the farmers would pay it back. So it went out and it came back. So it was stabilised. It was sustainable. It wasn’t just money going out and going out and going out.

Malcolm Roberts:

Okay. So we’re going to go for an ad break now, but before we do, I’ll just make a statement that we can ponder over the ad break. Ron Paul who’s very, very highly regarded. Former Senator says that the Federal Reserve Bank in America is neither federal, it’s not a government body, nor has it got any reserves. It’s a privately owned entity. Beyond the reach of the president, beyond the reach of Congress. And that leads to complete absence of restraints on bank’s power.

Malcolm Roberts:

Now we have bailouts and we have bail ins, which have been enabled to protect the banks at the cost of the everyday Australian. We’ve seen you’ve documented the international role and power of banking associations, like the bank for international settlements, the world bank, the international monetary foundation, their role in ruining nations and making nations dependent. The IMF international monetary I’ve forgotten what’s the F for? Foundation. I’ve forgotten.

Ellen Hodgson Brown:

Fund. International Monetary Fund.

Malcolm Roberts:

Thank you. I just had a complete blank will crippling, Mexico, crippling Russia, the Malaysian Prime Minister at the time McCarty he’s one of the feud have called out the globalist banks their power is enormous. So when we come back, let’s talk about the fact that Henry Ford said, “If the American people knew what was going on with banking, there’d be a revolution by morning.” So rather than have that revolution on the streets, could you talk about your main questions and I’ll remind them of remind you of them. What can we do about our unsustainable unrepayable, sovereign debts? What can we do about inflation? How do we make banks and banking work for the people? How to make national currencies honest? We’ll go for the ad break. And then we be right back with Ellen Hodgson brown to give us the solutions.

Speaker 1:

The midterms and America votes on November 8th, with his expert analysis and opinion. This is TNT radio with Jeremy Beck.

Jeremy Beck:

An important recall vote in San Francisco took place on the 7th of June alongside the many primary elections on the same day. Voters decided to oust the radical District Attorney Chesa Boudin whose soft on prime approach has overseen a horror show of lawlessness for the many victims of crime. Boudin is one of several dozen rogue prosecutors elected to public office largely thanks to funds from billionaire George Soros.

Malcolm Roberts:

So we’re back with Ellen Hodgson Brown discussing money and banking. So Ellen, what can we do about our unsustainable unrepayable sovereign debts? You’ve mentioned that the United States federal debt is now about $30 trillion, not counting unfunded future liabilities. What can we do about it?

Ellen Hodgson Brown:

Well, sovereign debt of course is the debt of the government. Dealing with personal debt is a lot harder. Actually the first money system I probably should have mentioned this was that the first money system in recorded history was the Sumerian money system, which Michael Hudson’s written a lot about. And it was just an accounting system, but they did charge interest. And when the debts got too high, they would have a debt Jubilee periodically. So they would wipe out all the debts and start all over. And that’s obviously the ideal, if you can do it. But the reason they could do it was that the king was considered the representative of the gods and the gods owned the land. And so the king could just order that the debts would be wiped off the clean slate. But today the debts are owed to private banks and we just wouldn’t be able to do it legally.

Ellen Hodgson Brown:

So doing a debt Jubilee for the people would be a lot harder, although it certainly would be, it seems like it’s needed because one problem with the way we create money is that banks create the principle, but they don’t create the interest. So debt always grows faster than the money supply, and there’s not enough money to pay it all back without borrowing more which means the debt just goes up and up and up. It’s a pyramid scheme. So how do we bring about a debt Jubilee under today’s circumstances? Alexander Hamilton actually had a very good plan, which I think we could do. Although you know obviously it’s probably not going to happen, but what Hamilton did with the state’s deaths, the colonies debts that became the states was to roll them to accept them in exchange for stock in the first US banks.

Ellen Hodgson Brown:

So you could pay partly in gold and partly in these debts. And we could actually take that $30 trillion in debt and turn it into stock in a big bank and pay some dividend on it. And actually, there is a bill that we have here in the US right now, a National Infrastructure Bank Bill, where they’re modelling it on the first US banker, the Hamiltonian model, where they would take federal securities and in exchange for stock in the bank. And that’s how they would capitalise it. So that’s one possibility. Another possibility, as long as you don’t pay interest on it, really the debt doesn’t hurt. If you just keep rolling it over and over and over. So you could just have the Federal Reserve buy all the debt. The central bank returns its profits to the treasury.

Ellen Hodgson Brown:

So it doesn’t keep the interest. It’s really the interest that’s the problem. That’s the thing that we have to pay year after year and projections are that in a few years, it’s going to be up to something like a trillion dollars a year just for the interest. So that’s getting right up there with the military and are really expensive things in the budget. But that’s another possibility. In other words, you can just keep rolling it over and hold it by your own central bank assuming your central bank were actually publicly owned and controlled and serving the people. So it could be dealt with. Now foreign sovereign debts, it does look like half the world is likely to join this new [inaudible 00:37:10] system and just walk away from their debts. That’s what Sergei Glazyev said that they don’t need to pay their debts.

Ellen Hodgson Brown:

They just walk away from the debts in dollars and start their own system. And that could happen. Would it destroy the dollar? I don’t think so. Because of the amount of dollars that are out there in the Euro dollar system, I mean the dollar is basically our unit of account. It’s just how people measure value. And it’s so entrenched that I’ve read other experts who say that it probably can’t be shaken loose even if half the world does abandon the dollar and take up some other currency, but I’m getting far a field again. Sorry.

Malcolm Roberts:

So Ellen, before we move on to the solving inflation your ideas on comments on that, there are many different ways of do doing this, but what seems to be coming out of it is that we need to talk about it. We need to have an open Frank discussion about it. We need to have the truth on the table. We need to understand who owns what in this, who controls what so that we can then establish a system that is good for the people rather than just for a few globalist predators.

Ellen Hodgson Brown:

Right. Transparency and accountability. Totally.

Malcolm Roberts:

And they’re the enemies at the moment and so there’s no transparency. A lot of this is hidden. Okay. So the solution is not an easy one, but it must be achieved. If we don’t achieve a solution by open honest frank discussion, then it’ll come through some form of control and that’ll be devastating for everyone ultimately for the global predators themselves. So what to do about inflation Ellen?

Ellen Hodgson Brown:

Well, the argument is that this is a monetary inflation, and they’re trying to tighten the money supply and not supposed to fix it, but it’s not a monetary inflation. It’s a supply problem. There’s two sides to inflation that you often hear that inflation is always and everywhere, monetary phenomenon. But that’s not true. It’s half a monetary phenomenon, it’s a half a supply phenomenon. In other words, if money goes up and supply goes down, you’re going to have too much money competing for too few goods.

Ellen Hodgson Brown:

But if you can keep the supply and the money in balance, then you don’t have inflation, then prices remain stable. So what we need to do is up the supply, which a good infrastructure bank would do it, we’ve got the amazing model of China that in a couple of decades, they came up from absolute poverty for most of their people up into well, anyway, how did they do it?

Ellen Hodgson Brown:

But they have these infrastructure banks where they just basically create the money as credit build the thing like the high speed rail, and then the fees from the trains pay back the loan. And that’s the way it should be. You extend the credit, you use the credit to build something productive, don’t keep pumping it into existing houses, which will just drive the price of houses up. But you put it into new productivity, new infrastructure, which we desperately need in the US and probably, I don’t know how Australia is, but here we got a serious infrastructure problem, build new infrastructure, put money into all sorts of productive things. That’s what Roosevelt did in the 1930s with the Reconstruction Finance Corporation, he funded anything that was productive that would pay back, not speculative, but actual producing assets. So that’s what we need to do.

Malcolm Roberts:

Okay. That makes sense, because if you generate something in terms of productive infrastructure, and then you use that to generate wealth, then you don’t have inflation and you do have prosperity wealth.

Ellen Hodgson Brown:

The interest rates is going to just make it worse because all the producers have credit lines and they’re not going to be able to afford their credit lines. We’re already seeing that business is falling off.

Malcolm Roberts:

And what you just said worked in the Commonwealth Bank when it was a true public bank in the early part of last century generated infrastructure and we… We’ll come to that more later. I won’t go on any more of that now. How do we make banks, coming to your fourth question, how do we make banks and banking work for the people Ellen?

Ellen Hodgson Brown:

Well, they need to be public institutions, publicly owned and controlled, the sustainable, transparent and accountable that they need to be. When we have this, the public banking institute, our mission is to try to get public banks established in the US like the Bank of North Dakota. And you often hear people say, you want to give the government a bake, because people don’t trust the government anymore than they trust bakers, but you need to design the system so that it is responsive to the people, accountable, transparent and so that we actually have control over it.

Malcolm Roberts:

So that again mimics what happened with the Commonwealth Bank. The Commonwealth Bank, when it was formed. The first governor was a man named Dennison Miller who was very energetic man who really aspired to do something really well. And he was working for the Bank of New south Wales. What is now known as Westpac. He was taken from Westpac of Bank of New South Wales and made in charge of the Commonwealth Bank. And he had a wonderful objective then to do the best for the country.

Malcolm Roberts:

And he basically ran the Commonwealth Bank very, very well and worked for the country despite Labour Party and Liberal Party or the precursor Liberal Party, trying to undo it all because one of the things that the Commonwealth Bank did when it was a true people’s bank in the early part of last century, was it provided competition for the private banks. The private banks were then held accountable, which is what you just said. The accountability is so important, but that accountability has to be to the people you’d agree with that.

Ellen Hodgson Brown:

Right. Totally.

Malcolm Roberts:

Okay. Thank you for mentioning the Commonwealth Bank in your book, the Web of Debt. The fourth question, your last question.

Ellen Hodgson Brown:

[inaudible 00:43:57] very inspiring.

Malcolm Roberts:

Yes. The fourth question you suggested was how to make national currencies honest? How do we make them honest? Because as you pointed out at the moment, whether it’s seashells or paper or trinkets or tally sticks or whatever medium is that it can be corrupted. It’s not necessarily backed by anything. There’s no real reserve there. There’s no real value there other than what it’s deemed to be valued. It’s Fiat. It’s an announcement, a pronouncement. So how do you make national currencies honest?

Ellen Hodgson Brown:

Well, I’m not actually opposed to national currencies. I’m not sure I know the answer to that. There are a lot of people attempting to establish an alternative currency system, like a cryptocurrency system, a crypto currency would be honest if it’s backed by something like food back currencies, I think would be a great idea where it’s basically an advance against the future productivity of the farmers. They could issue their own cryptocurrency. But anyway, I think our Fiat system is not that bad. It’s who creates it and who controls its creation. In other words, if you had public banks that were actually accountable and sustainable and what was the other word I forgot now, anyway, it’s getting late here. So if you had public banks that were there to serve the people and the people in control of it actually had that sort of sense of mission that you could have an honest fiat currency.

Ellen Hodgson Brown:

Fiat currency is not really unbacked. It’s backed by the full faith and credit of the people, which means the people agree that to accept it. It so if I went to the grocery with a gold coin and tried to pay for my groceries and said this is worth 1800, whatever it’s at right now at 1850 or something, the grocer wouldn’t know what to do with it because they wouldn’t know for sure that it was valid. He’d say, “No, give me paper money or give me your credit card.” Because things are valued in the Fiat currency and that’s one of the properties of a good currency. I don’t know what, how do you answer it?

Malcolm Roberts:

It’s very difficult, but it seems to me that what you’ve said in answer to each of the four major questions is that it has to go back to being publicly owned bank, a government led bank, not, not necessarily led because governments can then do political things but an independent bank that’s independent from privately owned banks because privately owned banks are the root of the problem. These privately owned banks, these globalist predators, when things are going well, they love capitalism. When things are going badly, they want socialism.

Malcolm Roberts:

And that seems to be a major problem for these people because they make so many… Without any accountability, they make horrendous decisions which ultimately the people pay for in a loss of their house, the loss of their cars, the loss of productive capacity of the country, the decimation of a whole economy. And then you extend that power, that national power internationally through the Bank of International Settlements, the International Monetary Fund, the world bank, et cetera. You’ve got a huge problem and they’re basically controlled by the same globalist predators. So that seems to be the core to take it back and give it to the people. But either way you’ve done a marvellous job in painting the fact that there are no simple solutions and yet there is a basic simple solution and that is people’s banking. Ellen, can I ask you some personal questions?

Ellen Hodgson Brown:

Sure.

Malcolm Roberts:

Because I’ve got just two minutes to go and I like to finish on the hour rather than early. First of all, I want to thank you so much for joining us. And I look forward to staying in touch, but I read that you were born in 1945, that makes you almost 77, 76. How do you do it?

Ellen Hodgson Brown:

Almost 77. Well, how do I do it?

Malcolm Roberts:

Yeah. You look at the research, you’ve done the clarity, your ability to say that it’s not all bad. Some things that need to be considered, but you’re juggling all these complex concepts in your head.

Ellen Hodgson Brown:

Well, it’s incredibly interesting. Don’t you think?

Malcolm Roberts:

Oh yes.

Ellen Hodgson Brown:

You’re doing marvellous work and just the idea of cracking this nut. Like how do we figure this out? And, well, actually I got divorced if you want to get really personal 20 years ago. And I was quite depressed. And so at some point I said, “I don’t want this body anymore, but if somebody up there has a good idea for [inaudible 00:49:03].”

Malcolm Roberts:

So you took it on as a challenge. I’d want to give you the last say we’ve got 20 seconds left. How do they learn more about you? What’s your website?

Ellen Hodgson Brown:

Oh, ellenbrown.com or publicbankinginstitute.org.

Malcolm Roberts:

ellenbrown.com or publicbankinginstitute.org. Thank you so much Ellen. What a wonderful person you are. Thank you for being so open and honest.